Easy one. Collect your miles if you subscribe to emails for 60 days here.

Stay More Organized

I live in a city (Los Angeles) where lots of people are independently wealthy. Unfortunately, I’m not one of these people. I do things like hustling miles to help my budget work. Most of you, as readers of this blog, are not insanely rich either. So it blows my mind how much some of you spend on annual fees. When you keep paying annual fees on a card, it kind of defeats the purpose of doing all this. And the most common reason is, “It’s so hard to keep track of all these credit cards.”

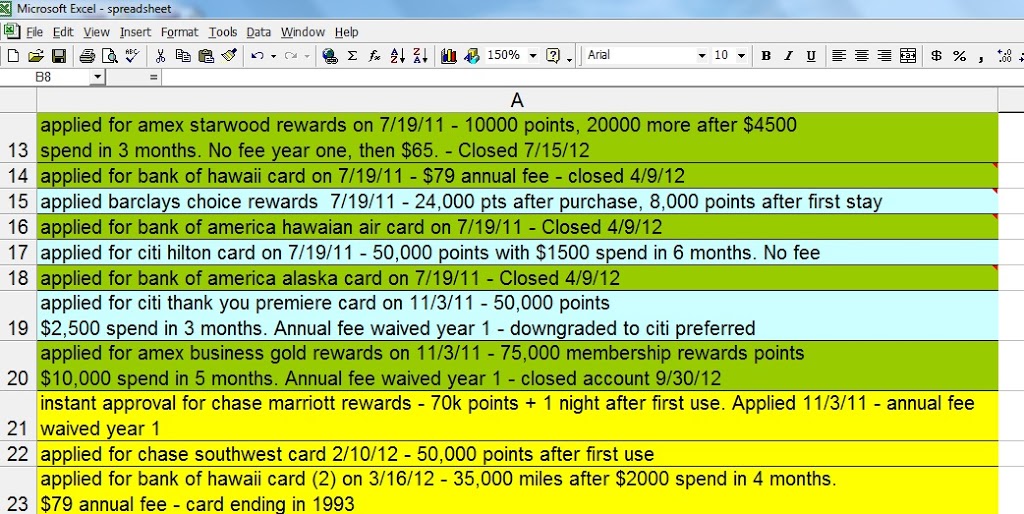

Is it really? Not for me. I spend 5 minutes a day with my spreadsheet and know exactly when an annual fee is coming. I also know when it’s time to apply for a new batch of cards. I plug in the basic information (the date I apply for a card, name of card, amount I need to spend, how fast I need to spend it, and amount of bonus miles). Then I color-code it:

- Yellow means I’ve earned the bonus miles, but the card is still open.

- Green means I’ve closed the account.

- Blue means there’s no annual fee, so I don’t have to worry about closing it.

- No color means I haven’t earned the bonus miles yet.

When To Churn

Churning (verb): When you apply for a credit card you’ve already had and earn the bonus again.

- Citibank cards seem to be churnable 18 months after the original application.

- Chase cards have to be closed 2 years before getting another bonus on the same card.

- American Express cards need to be closed a year to get a bonus on the identical card.

- Bank of America can be much more churnable if you have a good history there. I’ve gotten a card, closed it after 6 months, and collected another bonus a month later. With my Hawaiian Airlines card, I actually forgot to close the original and still got another one within 9 months.

(I did the same thing with the Bank of Hawaii version of the Hawaiian Airlines card)

- Barclays can be easy. I had my US Airways card closed 3 months before applying again. I’ve seen people get the card, not even close it, and get a second one within 6 months.

Hump Day Hustle

- Get up to 3,000 British Airways miles for a Hilton stay here.

- 100 free United miles here. PointsHound is a new way to earn miles from hotel bookings.

- Meet minimum spends even if you can’t find Vanilla Reload cards. How?

- Make sure you have a BigCrumbs account

- Find a Target that sells American Express For Target prepaid cards.

- Buy one for around $3 and load it with a few bucks.

- Your permanent card arrives in a few days.

- Go back to BigCrumbs and search for “American Express”

- Using any non-Citibank credit card, buy a $3,000 American Express gift card.

- Go to Target and load the Target prepaid card with $1,000 (the max).

- Unload the Target card at an ATM machine ($400 per day max).

- You also get 1.4% back from BigCrumbs ($42) which earns you a little profit.

Hotel Points And Netflix

- Get 500 Priority Club hotel points by changing your account settings here. Under “Edit Email Subscriptions,” select eStatements and save changes. Done.

- 1,500 Club Carlson hotel points for $7 here. With the 50% bonus, get 60,000 points for $280.

- A couple weeks left to get 2,500 American Airlines miles from Netflix here

- Some people are collecting United Airlines miles from Netflix over and over here.